Indian Bank Fixed Deposit Interest Rates

- Fixed Deposit Rates In India

- Indian Bank Fixed Deposit Interest Rates Highest

- Sbi Fixed Deposit Interest Rate

- Indian Bank Fixed Deposit Interest Rates Interest Rate

- Indian Bank Fixed Deposit Interest Rates

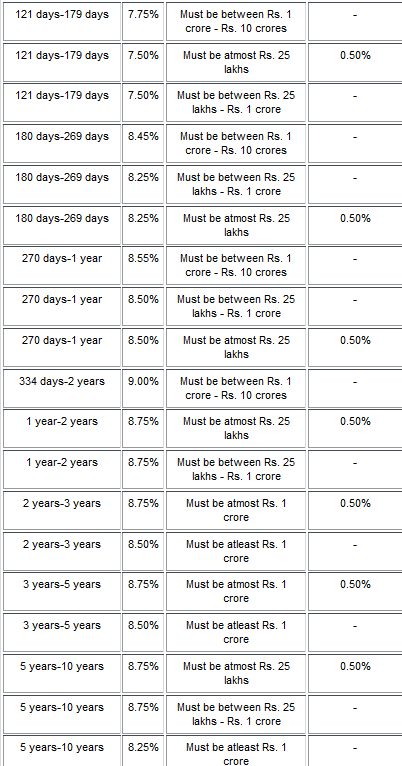

Revision of interest rate on Term Deposits w.e.f The interest rate applicable for “Deposit/s of above ₹ 5 crore” and approval for acceptance of such deposit/s shall be obtained from Treasury Branch. These rates will not be applicable for existing deposits booked at earlier rates. As interest rates are subject to change without prior notice, depositor shall ascertain the rates on the value date of the fixed deposit and interest will be paid at the contracted rate irrespective of change in the fixed deposit rates.

| You are here : | Products Personal Interest Rates |

Interest Rates - Deposit

| Interest rates effective from 15/12/2020 (Percentage per Annum) | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

| Interest is calculated on daily product basis and is credited on quarterly basis in the months of April, July, October and January every year. | ||||||||||||||||||||||||||||

| Saving Bank deposits rates w.e.f. 31.03.2020 |

| On balance upto & including Rs. 25.00 lakhs | 3.00% p.a. |

| On balance above Rs. 25.00 lakhs |

- Apply Online

- Interest Rates

New and Attractive Interest Rates

w.e.f. February 18, 2021

| Tenure | < Rs. 2 crores | |

| Interest Rate | Interest Rate for Senior Citizens* | |

| 181 - 270 Days | 3.65 | 3.65 |

| 271 - 1 Yr | 3.85 | 3.85 |

| > 1 Yr - 1.5 Yrs | 4.00 | 4.00 |

| > 1.5 Yrs - 2 Yrs | 4.25 | 4.25 |

| 5 Yrs | 6.00 | 6.00 |

Please note :

- Interest Rate per annum (%).

- Special interest rates quoted above are applicable for deposits of value less than Rs. 2 crores only.

- These interest rates will be applicable for new fixed deposits and renewal of existing fixed deposits booked from the effective date given above. These rates will not be applicable for existing deposits booked at earlier rates. As interest rates are subject to change without prior notice, depositor shall ascertain the rates on the value date of the fixed deposit and interest will be paid at the contracted rate irrespective of change in the fixed deposit rates thereafter.

- In case of monthly interest payout, interest shall be calculated for the quarter and paid monthly at a discounted rate in line with RBI directives.

- In case of deposits where interest is paid out at maturity (cumulative interest bearing deposits), interest is calculated and compounded every quarter, basis account opening date. This interest amount so calculated is added to the principal amount in your term deposit account at the end of every calendar quarter.

- The Bank considers both a leap year (366 days) and a non-leap year (365 days) as 1 completed year for calculating the tenure of a fixed deposit. In case a customer books a fixed deposit for 1 year in a leap or a non-leap year, the interest applicable on this deposit will be for the tenure 1 year. Similarly if a customer books a fixed deposit for 2 years, which is spread over a leap year and a non-leap year, the interest applicable on this deposit will be for the tenure > 1.5 Yrs - 2 Yrs. This condition will be applicable for all tenures >=1 year spanning a leap year and a non-leap year

NRE Fixed Deposit Rates

w.e.f. February 18, 2021

| Tenure | Interest Rate per annum (%) |

| 1 Yr | 3.85 |

| > 1 Yr - 1.5 Yrs | 4.00 |

| > 1.5 Yrs - 2 Yrs | 4.25 |

| > 2 Yrs - 3 Yrs | 4.50 |

| > 3 Yrs - 4 Yrs | 5.00 |

| > 4 Yrs - < 5 Yrs | 5.25 |

| 5 Yrs | 6.00 |

- Initial minimum fixed deposit size is Rs. 20,000.

- Premature withdrawal:

For Single Deposit of less than Rs. 2 crores

• Less than 1 year : no interest

• 1 year & above : In case of premature withdrawal of fixed deposits, the interest rate will be 1.00% below the applicable interest rate for the deposit. The applicable interest rate will be the rate as on the date of booking for the period for which the deposit has run. This will be applicable for all deposits including renewals - Interest rates are subject to change without prior notice.

- These interest rates will be applicable for new fixed deposits and renewal of existing fixed deposits booked from the effective date given above. These rates will not be applicable for existing deposits booked at earlier rates. As interest rates are subject to change without prior notice, depositor shall ascertain the rates on the value date of the fixed deposit and interest will be paid at the contracted rate irrespective of change in the fixed deposit rates thereafter.

- In case of deposits where interest is paid out at maturity (cumulative interest bearing deposits), interest is calculated and compounded every quarter, basis account opening date. This interest amount so calculated is added to the principal amount in your term deposit account at the end of every calendar quarter.

- The Bank considers both a leap year (366 days) and a non-leap year (365 days) as 1 completed year for calculating the tenure of a fixed deposit. In case a customer books a fixed deposit for 1 year in a leap or a non-leap year, the interest applicable on this deposit will be for the tenure 1 year. Similarly if a customer books a fixed deposit for 2 years, which is spread over a leap year and a non-leap year, the interest applicable on this deposit will be for the tenure > 1.5 Yrs - 2 Yrs. This condition will be applicable for all tenures >=1 year spanning a leap year and a non-leap year

Domestic / NRO Fixed Deposit Rates

w.e.f. February 18, 2021

| Tenure | < Rs. 2 crores | |

| Interest Rate | Interest Rate for Senior Citizens* | |

| 7 Days | 1.80 | 1.80 |

| 8 - 14 Days | 1.80 | 1.80 |

| 15 - 29 Days | 2.50 | 2.50 |

| 30 Days | 3.00 | 3.00 |

| 31 - 45 Days | 3.00 | 3.00 |

| 46 - 59 Days | 3.00 | 3.00 |

| 60 - 89 Days | 3.25 | 3.25 |

| 90 - 99 Days | 3.50 | 3.50 |

| 100 Days | 3.25 | 3.25 |

| 101 - 180 Days | 3.25 | 3.25 |

| 181 - 270 Days | 3.65 | 3.65 |

| 271 Days - 1 Yr | 3.85 | 3.85 |

| > 1 Yr - 1.5 Yrs | 4.00 | 4.00 |

| > 1.5 Yrs - 2 Yrs | 4.25 | 4.25 |

| > 2 Yrs - 3 Yrs | 4.50 | 4.50 |

| > 3 Yrs - 4 Yrs | 5.00 | 5.00 |

| > 4 Yrs - < 5 Yrs | 5.25 | 5.25 |

| 5 Yrs | 6.00 | 6.00 |

Please note :

- Interest Rate per annum (%).

- Special interest rates quoted above are applicable for deposits of value less than Rs. 2 crores only.

- No interest is payable for deposits withdrawn prematurely before 7 days.

- Premature withdrawal

In case of premature withdrawal of fixed deposits on 7th day or thereafter, the interest rate will be 1.00% below the applicable interest rate for the deposit. The applicable interest rate will be the rate as on the date of booking for the period for which the deposit has run. This will be applicable for all deposits including renewals. - Minimum fixed deposit amount is Rs. 20,000.

- Interest Rates are subject to change without prior notice.

- The following interest payout options available for the customer

• Monthly

• Quarterly

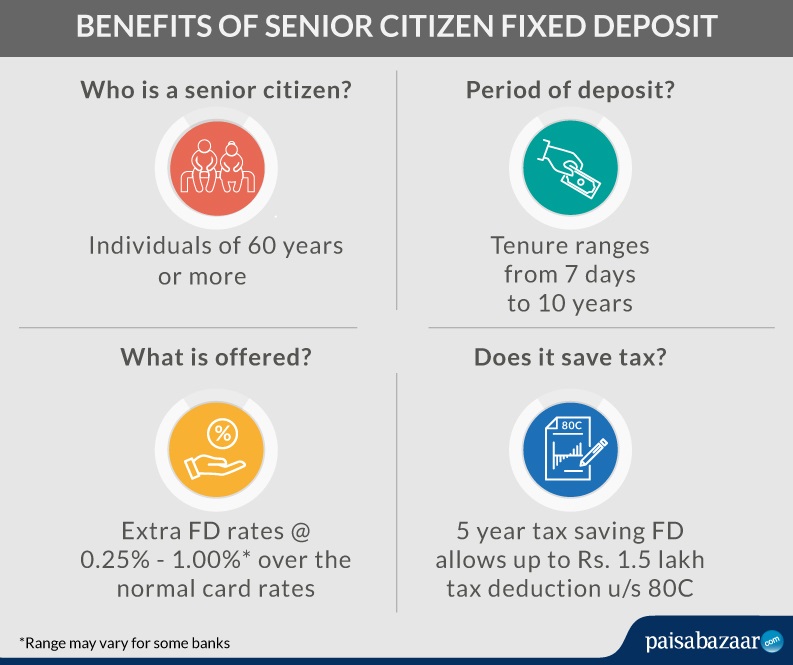

• Cumulative - *Applicable only for Retail Deposits - Resident Indian Senior Citizens i.e. Resident Individuals of age

60 years & above and excludes Non-Resident individuals, Individuals in their capacity as a Karta in HUFs and all non individuals. Incase of joint accounts the first holder should be a senior citizen to avail of these rates. - These interest rates will be applicable for new fixed deposits and renewal of existing fixed deposits booked from the effective date given above. These rates will not be applicable for existing deposits booked at earlier rates. As interest rates are subject to change without prior notice, depositor shall ascertain the rates on the value date of the fixed deposit and interest will be paid at the contracted rate irrespective of change in the fixed deposit rates thereafter.

- In case of monthly interest payout, interest shall be calculated for the quarter and paid monthly at a discounted rate in line with RBI directives.

- In case of deposits where interest is paid out at maturity (cumulative interest bearing deposits), interest is calculated and compounded every quarter, basis account opening date. This interest amount so calculated is added to the principal amount in your term deposit account at the end of every calendar quarter.

- The Bank considers both a leap year (366 days) and a non-leap year (365 days) as 1 completed year for calculating the tenure of a fixed deposit. In case a customer books a fixed deposit for 1 year in a leap or a non-leap year, the interest applicable on this deposit will be for the tenure 1 year. Similarly if a customer books a fixed deposit for 2 years, which is spread over a leap year and a non-leap year, the interest applicable on this deposit will be for the tenure > 1.5 Yrs - 2 Yrs. This condition will be applicable for all tenures >=1 year spanning a leap year and a non-leap year

Domestic / NRO and NRE Fixed Deposit Rates greater than or equal to Rs. 2 crores

For rates greater than or equal to Rs. 2 crores please click here

Interest rates for deposits greater than or equal to Rs. 2 crores are updated on a daily basis and interest rates updated on a Friday are valid for the following Saturday and Sunday. In case of non-updation of today’s interest rate, please revisit later to check the updated rates.

Please note :

- Interest Rate per annum (%).

- Interest Rates are subject to change without prior notice.

- No interest is payable for Resident / NRO deposits withdrawn prematurely before 7 days.

- No interest is payable for NRE deposits withdrawn prematurely before 1 year.

- Premature withdrawal for Resident / NRO deposits

In case of premature withdrawal of fixed deposits on 7th day or thereafter, the interest rate will be 1.00% below the applicable interest rate for the deposit. The applicable interest rate will be the card rate for deposits greater than or equal to Rs. 2 crores as on the date of booking and for the period for which the deposit has run. This will be applicable for all deposits including renewals. - Premature withdrawal for NRE deposits

In case of premature withdrawal of fixed deposits on 1 year or thereafter, the interest rate will be 1.00% below the applicable interest rate for the deposit. The applicable interest rate will be the card rate for deposits greater than or equal to Rs. 2 crores as on the date of booking and for the period for which the deposit has run. This will be applicable for all deposits including renewals. - The following interest payout options available for the customer

• Monthly

• Quarterly

• Cumulative - These interest rates will be applicable for new fixed deposits and renewal of existing fixed deposits booked from the effective date given above. These rates will not be applicable for existing deposits booked at earlier rates. As interest rates are subject to change without prior notice, depositor shall ascertain the rates on the value date of the fixed deposit and interest will be paid at the contracted rate irrespective of change in the fixed deposit rates thereafter.

- In case of monthly interest payout, interest shall be calculated for the quarter and paid monthly at a discounted rate in line with RBI directives.

- The Bank considers both a leap year (366 days) and a non-leap year (365 days) as 1 completed year for calculating the tenure of a fixed deposit. In case a customer books a fixed deposit for 1 year in a leap or a non-leap year, the interest applicable on this deposit will be for the tenure 1 year. Similarly if a customer books a fixed deposit for 2 years, which is spread over a leap year and a non-leap year, the interest applicable on this deposit will be for the tenure > 1.5 Yrs - 2 Yrs. This condition will be applicable for all tenures >=1 year spanning a leap year and a non-leap year.

Interest Rates for Recurring Deposit

w.e.f. February 18, 2021

| Maturity Period | Interest Rate | Interest Rate for Senior Citizens* |

| 12 months | 3.85 | 3.85 |

| 15 months to 18 months | 4.00 | 4.00 |

| 21 months to 24 months | 4.25 | 4.25 |

| 27 months to 36 months | 4.50 | 4.50 |

| 39 months to 48 months | 5.00 | 5.00 |

| 51 months to 57 months | 5.25 | 5.25 |

| 60 months | 6.00 | 6.00 |

Please note :

- Minimum ticket size of Rs. 5,000 to a maximum of Rs. 200,000.

- Minimum tenure of 12 months (in multiplies of 3 months thereafter).

- Maximum tenure of 60 months.

- The interest on Recurring Deposits will be calculated by the bank in accordance with the directions advised by Indian Banks' Association.

- Interest on Recurring Deposits will be paid out on maturity.

- Premature withdrawal:

In case of premature withdrawal of recurring deposits, the interest rate will be 1.00% below the applicable interest rate for the deposit. The applicable interest rate will be the rate as on the date of booking for the period for which the deposit has run. This will be applicable for all deposits including renewals. - If the Recurring Deposits is broken within 14 days from the date of booking, no interest will be paid.

- Interest Rates are subject to change without prior notice.

- Partial withdrawal is not allowed for recurring deposits.

- In case an installment is failed, SI failure charges as per schedule of charges will be applicable.

- *Applicable only for Retail Deposits - Resident Indian Senior Citizens i.e. Resident Individuals of age

60 years & above and excludes Non-Resident Individuals, Individuals in their capacity as a Karta in HUFs and all non individuals. Incase of joint accounts the first holder should be a senior citizen to avail of these rates. - These interest rates will be applicable for new fixed deposits and renewal of existing fixed deposits booked from the effective date given above. These rates will not be applicable for existing deposits booked at earlier rates. As interest rates are subject to change without prior notice, depositor shall ascertain the rates on the value date of the fixed deposit and interest will be paid at the contracted rate irrespective of change in the fixed deposit rates thereafter.

- In case of deposits where interest is paid out at maturity (cumulative interest bearing deposits), interest is calculated and compounded every quarter, basis account opening date. This interest amount so calculated is added to the principal amount in your term deposit account at the end of every calendar quarter.

- The Bank considers both a leap year (366 days) and a non-leap year (365 days) as 1 completed year for calculating the tenure of a fixed deposit. In case a customer books a fixed deposit for 1 year in a leap or a non-leap year, the interest applicable on this deposit will be for the tenure 1 year. Similarly if a customer books a fixed deposit for 2 years, which is spread over a leap year and a non-leap year, the interest applicable on this deposit will be for the tenure > 1.5 Yrs - 2 Yrs. This condition will be applicable for all tenures >=1 year spanning a leap year and a non-leap year.

Apply for Fixed Deposit

SMS FD to 561615

Call 18602666601#

#Customers outside India need to dial +91 22 6601 6601. Customers in Mumbai can also call at +91 22 6601 6601. Call charges apply.

Fixed Deposit Rates In India

Useful Information

Indian Bank Fixed Deposit Interest Rates Highest

•Loan Interest Certificate

•EMI Calculator

•Pay Tax Online

•Create IPIN Online

•Verified By Visa (VBV)

Sbi Fixed Deposit Interest Rate

•Schedule of charges

•Fixed / Recurring Deposit Calculator

•Important Information

•Safe Banking

•Digital Signature Certificate

Indian Bank Fixed Deposit Interest Rates Interest Rate

•Financial Results

•Privacy Policy

•Do-Not-Call Service

•Customer Feedback

•Positive Pay

Indian Bank Fixed Deposit Interest Rates

•About Us

•Form Centre

•ATM / Branch Locator

•Awards

•Sitemap