Paytm Fixed Deposit

- Paytm Fixed Deposit Credit Cards

- Paytm Fixed Deposit Bonus

- Paytm Fixed Deposit Customer Care Number

- Fixed Deposit Malaysia

- Fixed Deposit Calculator

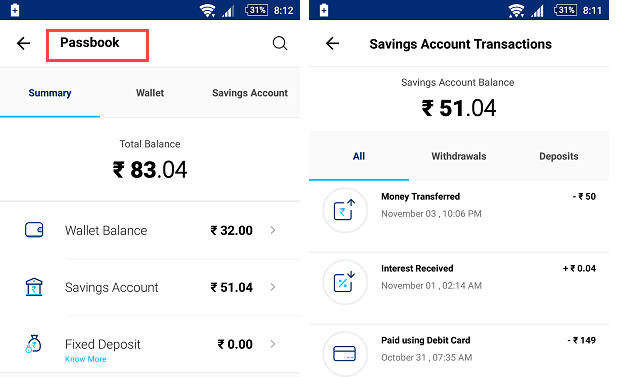

What are the Benefits of Opening a Savings Account with Paytm Payments Bank? Some of the key benefits of Savings Account are as follows: Zero Balance Account with 4% interest; Auto-sweep Fixed Deposit with upto 6.5 interest; Break FD anytime without any penalty charges; Unlimited and FREE Bank to Bank money transfer. Firstly, we know that what is Paytm Payment Bank, after that we will know how to add or deposit money in Paytm Payment Bank account? What is Paytm Payment Bank? Paytm Payment Bank is India’s first mobile bank where you can open your account with zero balance. In Aug 2015, Paytm Payment Bank was licensed by the Reserve Bank of India. Paytm fixed deposits are actually kept with IndusInd bank because of RBI’s Payment Bank operating guidelines. So it is as safe as opening an FD with IndusInd Bank directly. You can find more details here. 1) You are new to the Paytm app – you have never registered with Paytm before 2) You have registered on Paytm app,but have not done in-person verification (Full KYC) with Paytm Payments Bank. If you have already done the in-person verification (KYC) with us and, you already have a wallet with higher limits, this New Paytm Wallet is not for you.

Firstly, we know that what is Paytm Payment Bank, after that we will know how to add or deposit money in Paytm Payment Bank account?

What is Paytm Payment Bank?

Paytm Payment Bank is India’s first mobile bank where you can open your account with zero balance. In Aug 2015, Paytm Payment Bank was licensed by the Reserve Bank of India. Its founder is Vijay Shekhar Sharma and Satish Kumar Gupta as a CEO & Managing Director. The bank was inaugurated by Indian Finance Minister Arun Jaitley in November 2017.

You can deposit your money up to 1 lakh in this bank and earn interest at 2.75% per annum which will be paid every month. You will also get a free Virtual Rupay Debit Card by the bank, which can help you in doing online transactions. If you want, you can also get a physical debit card by paying Rs.250 Physical Card Issuance Charge. After this, you will have to pay an annual subscription fee of Rs.150 and the daily limit will be up to Rs.1,00,000.

How to add or deposit money in Paytm Payment Bank account?

Follow these 5 steps to add or deposit money in Paytm Payment Bank Savings Account:

1. UPI Linked Bank Account

You can add money in Paytm Payment Bank from your UPI linked bank account. If you don’t see any UPI Linked Bank account there that means you haven’t any UPI Linked handle yet and you have to first link your UPI handle then after you will be able to add money.

- Enter the amount you want to add

- Select your UPI Linked Bank Account and click the Proceed Securely button

- Enter your 6 digit UPI pin and click OK

- Now, your money will be successfully added to the Paytm Payment Bank account.

2. Paytm Wallet

You can add money up to Rs.100 to 25,000 from Paytm wallet in Paytm Payment Bank and you will be able to add money as much as the balance in your wallet.

- Enter the amount you want to add

- Select the Paytm balance option and click on the Proceed button

- Enter the OTP sent in your Paytm registered mobile number and click on verify

- Now, your money will be successfully added.

3. Fixed Deposit

You can add money by the Fixed Deposit process only if you have made a Fixed Deposit at the Paytm Payment Bank. To add money, you have to break your Fixed Deposit.

- Enter the amount you want to add

- Select Break Your Fixed Deposit option

- Lastly, click on the Proceed button to add the money.

4. Debit Card

To add money in Paytm Payment Bank with a debit card by entering the details of your Debit Card. You can add only 2000 rupees at a time.

- Enter the amount you want to add

- Select the Debit Card option

- Fill in your Debit Card details ( Card Number, Expiry Date and CVV )

- If you don’t want to fill in these details again, then you should tick on ‘Save this card for future payments’. After this, you have to enter the CVV number and OTP only to add the money.

- Click on Proceed Securely and enter the OTP sent in your registered mobile number to complete the transaction.

5. Your Account With Another Bank

You can add money from another bank account by opening your another bank’s app and website. Fill in your Name, Account Number, IFSC code of Paytm Payment Bank to transfer money.

6. Nearby Points

You can also add money by visiting nearby points of Paytm. Firstly, You have to locate your Nearby Points by clicking on ‘Visit Nearby Points to deposit cash in Savings Account’. When you give cash to Paytm official point, your money is added in Paytm Payment Bank.

Read more: Full details of Meesho Supplier Panel or Login

How to Close Paytm Payments Bank Fixed Deposit Account?: Bank Fixed Deposit or Term Deposit is a deposit scheme where you can invest money in lump sum for a fixed pre-decided tenure at a given rate of interest. Paytm Payments Bank offers Fixed Deposit (FD) products of multiple tenures at competitive interest rates and with many other benefits like loan or overdraft facility against Fixed Deposit. It is usually seen that if someone opens a bank FD account, he/ she rarely closes it before maturity in order to achieve the financial objectives for which it was opened. Premature closure is not considered a good option as you bear financial loss if you close your FD before maturity.

However, still there could be multiple reasons to close a bank Fixed Deposit Account such as:

- Emergencies in the family

- Lower rate of interest

- Customer Service is not upto the mark

- Requirement of funds for purchase of some asset

- Bad Relationship with Bank Staff

- Better interest rate is being offered by other bank

- Better opportunity for investment

In order to close your Fixed Deposit Account, you may be interested to know how to close bank Fixed Deposit Account? It seems tedious but it's very easy to get your account closed, you just need to follow a few steps for the same.

Alternate Ways instead of Closing Bank Fixed Deposit Account of Paytm Payments Bank

Paytm Fixed Deposit Credit Cards

- A loan against fixed deposits can help you manage finances without breaking your investment.

- Arrange the funds for emergency from your family, friends or relatives, if your FD maturity date is very close.

- Avail Personal Loan, in case it is financially viable option.

How to close Paytm Payments Bank Fixed Deposit Account?

If you have a Fixed Deposit Account with Paytm Payments Bank and interested to know how to close it then following are the steps will have to follow:

Paytm Fixed Deposit Bonus

(1) Fill up the FD Account Closure Form or Fixed Deposit Liquidation form of Paytm Payments BankIn order to close Paytm Payments Bank FD account, the first step is to fill up an FD Account Closure Form. For this, you can visit your branch, get the FD account closure form and fill it up properly. After that you need to sign it and submit it to the branch manager/ officer-in-charge. Please note that if there is/ are any joint holder/s in your account, all need to sign the FD account closure form.

(2) Attach your KYC (Know Your Customer) DocumentsAll the holders of the account need to attach a copy of KYC documents i.e. a copy of PAN, which also serves as your proof of identity and a proof of address to the FD closure form. The account holders may also be asked to self attest these documents.

(3) Submit FD Certificate or FD ReceiptWhenever you apply for bank FD, the bank issues a deposit certificate or receipt as a proof of fixed deposit. It shows the details like FD amount, Tenure and Rate of Interest. You need to carry this certificate or receipt to close a fixed deposit. You need to submit FD certificate or receipt duly signed by all the account holders. The banker will verify the documents submitted by you and if he/ she finds all the things are correct then you are asked to withdraw the balance amount in your account. You may either take cash withdrawal or the bank issues a cheque/ DD in your favour or the amount can be transferred to another account.

If you follow above steps, you would be able to close your FD account in a hassle free manner. Banks generally send an email or SMS on your registered email id and mobile after your FD account is closed.

Paytm Fixed Deposit Customer Care Number

Important Points regarding Closing of Paytm Payments Bank Fixed Deposit Account

Fixed Deposit Malaysia

- For closing your FD account, you need to visit that branch of the bank where you had opened the account.

- Some of the banks offer FDs with minimum lock-in period which means that if you withdraw your FD before the lock-in period, no interest will be paid.

- On premature closure of Fixed Deposit, usually a penalty of 0.50% to 1% lower interest is levied. One will not get the original interest on FD amount for the entire tenure of the FD, but will be paid the lower interest rate less penalty for the period in which the FD was withdrawn.

- Any type of tax-saver FD cannot be withdrawn prematurely i.e. you cannot withdraw the amount before a lock in period of 5 years.

- Loan and Overdraft facility is not available against tax-saver FDs.