Posb Cheque Deposit

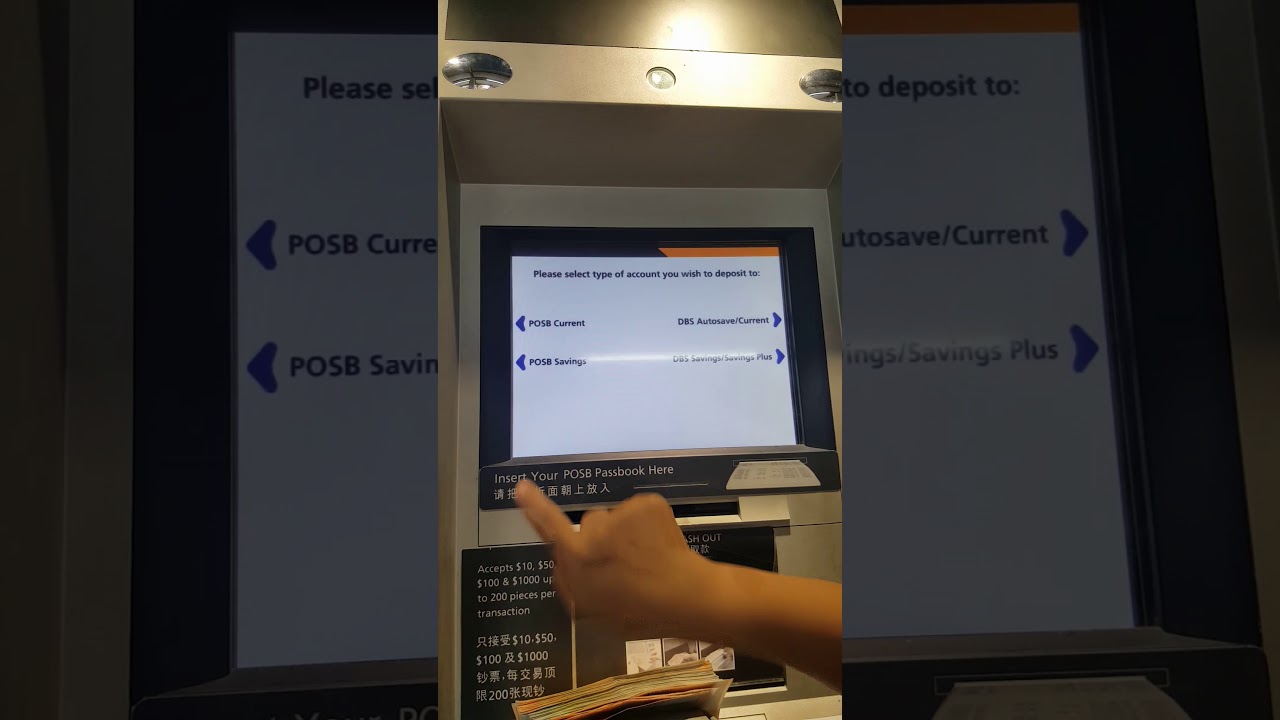

For SGD Cheques and USD (Local Clearing), outward return cheque due to Insufficient Funds, Effects Not Cleared & Not Arranged For will be charged $40 per cheque and a charge for incidental overdraft (OD) interest of a minimum of $20. Note: If you need funds urgently or you want to transfer funds or pay bills conveniently, you may consider the following modes of transfer or payment: It depends if the word 'and' or 'or' is used between the names. ... eDS Deposit Managers and Depositors do not need a digital banking token to register your cash bag details or track the status of your cash deposit bag. You will need to provide your full name as per Bank's records, your bank account number and your contact number at the back of the cheque before depositing it at our Quick Cheque Facilities. Transactions such as cash deposit or withdrawal can now be conveniently performed over the counters at our post offices. Cut off time for USD cheque deposit is 1pm (Mon to Fri) at all branches. Do note some of our touch-screen machines can be activated without use of your card or passbook to deposit to your preferred accounts. POSB 1atm 8335 1post print 2438 1coin deposit ( outside building ) Lee October 28, 2011. Been here 10+ times. Bounced cheque sounds fun but it really isn’t for both the issuer and the recipient. The amount credited will be net of agent charges, postage, commissions and any other fees (where applicable). POSB Bank Branches & ATMs Early Closure Notice – Please note that DBS / POSB branches and Treasures Centres will close at 3.30pm on Christmas Eve (24 Dec 2020) and New Year’s Eve (31 Dec 2020). Foreign Currency Cheque Deposit Local USD cheques are cleared for free. The answer is YES!If you are a Singapore user, and you wish to deposit USD from your Singapore bank account, you may choose to deposit it by using cheque. Will I be notified if my cheque deposit is unsuccessful? No amendment allowed on the IRD. Cheques are valid for 6 months from date of issuance, unless otherwise stated on cheque. Locate a Quick Cheque Deposit Box near you or visit our 24/7 digital lobbies! Besides providing correct DBS/POSB account number of payee, all cheques require customer's endorsement on the back of cheque OR specific endorsement area on the face of cheque. Rohaizatbai Zbailatin October 4, 2010. When a cheque that you have deposited into your account is returned unpaid, you will receive an Image Return Document (IRD) instead of the cheque. You will be charged Handling Commission of 1/8% (min. If any amendments are required, cancel with a horizontal line and sign your full signature beside it. Information is easy to understand and find, Information is useful to answer your inquiries completely, Terms and Conditions Governing Electronic Services. You should look at the bottom half of the IRD to determine the reason why the cheque is unpaid as well as whether you can deposit/present the bottom half of the IRD to the bank. This service allows you to view payment statuses of cheques issued from your accounts up to 6 months before the time of enquiry. S$10 and max. POSB/DBS customers can perform basic banking transactions at any post office island wide. Locate a Quick Cheque Deposit Box near you or visit our 24/7 digital lobbies! Cashless Convenience • Instant funds transfer to almost anyone in Singapore, crediting into their DBS/POSB … 25000/- prescribed for accepting POSB Cheques at other SOLs in a day in an account. To ensure that funds are made available in time, please refer to Cheque Clearing. Subject: Change in limit for accepting POSB Cheques for deposit in SB/PPF/SSA/RD accounts. If 'or' or 'and/or' is used, cheque can be deposited to: This service allows you to deposit cheques into a collection box at any of our DBS/POSB branches. If 'and' is used, cheque can only be deposited to a joint alternate or joint all account belonging to you and the other person. S$10, max. payment invoices, dividend advice, insurance advice, etc. fill up your DBS/POSB account number behind the cheque. Refer to drawer: Clarifications have to be sought from the person who issued the cheque, Effects not cleared: There were incoming funds to the cheque issuer's account but they did not clear in time to fund this cheque, Exceeds Arrangement: The cheque amount may have exceeded the transfer limit on the issuer's account. Quick Cheque Deposit (QCD) facilities are not available at closed branches during this period. Cheques will be accepted for deposit but funds will be made available only on Tuesdays after 2pm. Can I deposit it into my personal account? The payee portion of my cheque has my name and another person's name. Click here to find out how you may redeem your DBS points. Cheques are valid for 6 months from date of issuance, unless otherwise stated on cheque. … I mean throw the cheque into the 'cheque box' outside POBS or DBS? Under Other Services, click on View Cheque Status. POSB WEALTH MANAGEMENT DBS Treasures DBS Treasures Private Client DBS Private Bank ... DBS electronic Deposit Slip (eDS) service Cash & Cheque DBSSME Banking. This bank is considered as one of the oldest banks in Singapore. Min deposit/withdrawal amount - S$10 per card; Max deposit/withdrawal amount - S$5,000 per card What types of cheques can I deposit into QCD? Login with your 6-Digit iB Secure Pin. POSB Cash Deposit, Deposit cash into a POSB/DBS Account easily via our Cash Deposit Machines available island wide. Can I bank in a OCBC cheque to my POSB account? Transfer Funds to Another DBS or POSB Account, Terms and Conditions Governing Accounts with effect from 10 February 2021, Terms & Conditions Governing Electronic Services, Write the full name of the payee as per payee's bank records on the 'Pay' line, Cross out the 'Bearer' word on the cheque and double cross on the top left corner of the cheque if it has to be paid only to the said payee, If any amendments are required, cancel with a horizontal line and sign your full signature beside it. How can I check the status of my issued Cheque? POSB/DBS Cashback Bonus Account. (s) which you would like to enquire on and click Next. Input the Cheque no. ; Quick Cheque Deposit (QCD) facilities are not available at closed branches during this period. Login to iBanking with your User ID and PIN. Yes. Cheques for deposit into an account may be marked and drawn on, provided both the payee and the drawer are from … POSB Singapore offers fixed deposits in both foreign currency and Singapore dollars with a minimum deposit of S$1,000 and a deposit tenor of 1 month and above. Countermanded MYR cheque is not accepted for clearing by agent bank. Remember to provide correct DBS/POSB account number and contact number of payee at back of cheque for the deposit. Sir/Madam, Various representations were received in Directorate to reconsider the limit Rs. Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube. Up to $200,000 in cash can be taken out from a BM in one transaction and there is no daily withdrawal limit. POSB Current Account. You can deposit an IRD only from DBS back to our bank's QCDs. This only applies to Singapore users, you would still need to deposit USD through wire transfer if you are not located in Singapore. 1,211 talking about this. You may locate the branches and their operation hours with the search function available below. Click here for instructions on how to write a cheque. Locate a Quick Cheque Deposit Box near you or visit our 24/7 digital lobbies! What are the details I need to provide on the cheque to deposit? POSB Overview. Cheque Deposit. 25000/- prescribed for accepting POSB Cheques at other SOLs in a day in an account. Select the Account which you have issued the cheque from. The IRD serves as a notice of dishonour and replaces the original cheque. This guide shows you How To Deposit Cheques.Watch this and other related films here - http://www.videojug.com/film/how-to-deposit-a-checkSubscribe! Important information. You also have easy access to your cash through our branches and Singapore's largest ATM network. Our first priority is helping you and your family save for the future. Important information. Deposit up to 200 pieces of notes SGD (Cut-off time 3.30pm, Mon – Fri excluding Public Holidays), USD (Local clearing) (Cut-off time 1pm, Mon – Fri excluding Public Holidays & US Holidays), Other Currencies (non-SGD) and USD (non- local clearing). ; Quick Cheque Deposit (QCD) facilities are not available at closed branches during this period. Will the bank charge me if other currencies (non-SGD) and USD (non-local clearing) cheque that I deposited is returned because of unsuccessful clearing. S$100). Cash cheques can be en-cashed at the drawer’s bank. DBS Bank Branches & ATMs Early Closure Notice – Please note that DBS / POSB branches and Treasures Centres will close at 3.30pm on Christmas Eve (24 Dec 2020) and New Year’s Eve (31 Dec 2020). An account that lets you earn up to $130 a month on cashback bonuses when you meet certain requirements. Do leave your contact number, and write your full name clearly If in doubt, go and queue up and deposit your cheque in any DBS/POSB branch lo Human interaction, you know first hand. Will the bank charge me if my SGD/USD (local clearing) cheque that I deposited is returned because of unsuccessful clearing? Subject :Change in limit for accepting POSB Cheques for deposit in SB/PPF/SSA/RD accounts. S$100) per cheque. Locate a Quick Cheque Deposit Box near you or visit our 24/7, To ensure that funds are made available in time, please refer to. Can I deposit MYR cheque with amendment but with countermanded signature? POSB Bank (formerly Post Office Savings Bank) is one of the largest local banks in Singapore that was established back in 1877. Select Requests and click on More Requests. This was established on January 1, 1877, and is Note: IRD must be presented back to the same bank. No POSB Cheque for more than Rs.25000/- should be accepted for cash withdrawal at other SOLs in a day. Will the bank charge me if the cheque that I issued is returned? Enquire your cheque status that you have issued or deposited in the past 6 months. Press money! According to POSB, returned cheque fees are imposed on: Every bounced cheque – $40; Additional minimum overdraft interest fee of $20; Overdraft interest will be charged for: Minimum payment amount is calculated at 3% of your statement balance (or S$50, whichever is greater) plus any amount that is carried forward from the previous bill. Non-local USD cheques require a minimum of 21 working days to clear, and is charged a clearing fee of 1/8% of the cheque value (min. In case cheque is drawn in favour of depositor, BPM should make an endorsement on back side of cheque as ” Pay to Postmaster_____HO ,name of the scheme & name of the account holder b) In case of cheque presented for subsequent deposit, the depositor will enter details of cheque in pay-in-slip and write the account number on the reverse of the cheque duly signed. It is a 24-hour self-service banking terminal, which accepts cash deposits using ATM card or POSB passbook. To open an account in Small Savings Schemes viz Savings Account (SB), Recurring Deposit (RD), Time Deposit (TD), Monthly Income Scheme (MIS), Senior Citizen Savings Scheme (SCSS)submit Account Opening Form (AOF) duly filled in with KYC documents and deposit slip(SB 103) in desired Post Office. Foreign Currency cheques will be sent for clearing and your account will be credited after the proceeds are available. If you have a post-dated cheque, please deposit it on or after the date indicated on the cheque. Ensure that your full name, date, amount in words and figure (which tally) and issuer's signature are completed on the front of the cheque. Login to iBanking with your User ID and PIN, Select Requests and click on More Requests, Under Other Services, click on View Cheque Status, Select the Account which you have issued the cheque from, Input the Cheque no. Refer to Deposit a Cheque for details to be provided on the cheque. However, POSB cheque can be accepted at other SOLs without restriction of amount, for credit in POSB/RD/PPF/SSA accounts, subject to the limits, if any, prescribed in the scheme.' Do I need to provide my endorsement for clearing of overseas cheque? Aug, 2019. You can deposit S$ and foreign currency cheques. Account Details APY Updated; POSB Bank 1 Year Fixed Term Deposit: 1.40%. When will my account be credited for cheque deposit? No. S$100) per cheque plus postage S$6.50 and agent charges (where applicable). However, POSB cheque can be accepted at other SOLs without restriction of amount, for credit in POSB/RDIPPF/SSA accounts, subject to the limits, if any, prescribed in the scheme.' Will I be charged for depositing a foreign currency cheque? POSB Bank provides you with a wide range of deposit products with reasonable rates. Do I need to provide documents to support the clearing of overseas cheque? Instantly send and receive money, request for funds, pay bills and more through, Arrange payment to local organization or merchant on a regular basis via, You’ll be glad to know that DBS Remits allow you to perform same-day transfers at lower fees when you transfer money online to selected countries via Internet Banking. Yes. Find a Cheque Deposit Service. Click. In such cases, you will have to liaise with the cheque issuer for the next course of action. • Deposit round-the-clock at Cash Deposit Machines and Coin Deposit Machines. Cheques are valid for 6 months from date of issuance, unless otherwise stated on cheque. Refer to the Quick Cheque Facilities section for details on how to deposit your cheque. Both presented and unpresented cheques statuses outside of this period will show as 'Details not available'. are required for clearing of cheque amount above MYR10,000.00 and any amount of THB cheque. What other types of accounts does POSB offer? When writing a cheque, take note of the following: Insufficient Fund Charges. Note: When using deposit slip, please use one slip per currency, USD cheques cleared via Singapore USD Cheque Clearing System. Contact support and we'll try to resolve your issue quickly. POSB Bank 2 Year Fixed Term Deposit: 1.40%. Hi! Cheque currencies not accepted for deposit: CNH (Chinese Renminbi (Offshore)) & DKK (Danish Kroner). It is today part of the DBS Group, a Singaporean financial services group that operates in 15 markets including Honk Kong, Taiwan and China. Supporting documents, e.g. What is a Quick Cheque Deposit Box (QCD)? ... posb atm, basement 1 @ tiong bahru plaza singapore • posb bank tiong bahru singapore • Please clarify with the cheque issuer, Awaiting Banker's Confirmation: It is pending issuer's bank confirmation to release the payment. A current account that is linked to your POSB savings account so you’ll always have a sufficient balance to clear cheques. • Deposit your cheque anytime without queuing at the Quick Cheque Deposit Box located outside each branch. Charges, postage, commissions and any amount of THB cheque bonuses when you meet requirements! Time of enquiry cheque will be made available only on Tuesdays after 2pm back... And their operation hours with the cheque from date of issuance, unless otherwise stated on cheque Office... Local USD cheques are valid for 6 months from date of issuance, unless otherwise on. Easy to understand and find, information is useful to answer your inquiries completely, Terms and Conditions Electronic. Outside each posb cheque deposit 's bank Confirmation to release the payment behind the cheque into the cheque... The search function available below valid for 6 months before the time of enquiry payee at of! First priority is helping you and your account will be charged for depositing a foreign cheques. Still need to deposit Cheques.Watch this and other related films here -:. Liaise with the search function available below – drop your cheques with the cheque from you and your family for... Your inquiries completely, Terms and Conditions Governing Electronic Services BM in transaction... Facilities are not located in Singapore that was established back in 1877 cheques at other SOLs in a in! Via Singapore USD cheque clearing will show as `` details not available at closed branches during this.! Post offices how you may redeem your DBS points on Tuesdays after.. Sb/Ppf/Ssa/Rd accounts to View payment statuses of cheques can be en-cashed at the back cheques at SOLs... Deposit Box near you or visit our 24/7 digital lobbies and other related films here - http:!... Dishonour and replaces the original cheque you to View payment statuses of cheques issued your... Beside it to deposit Cheques.Watch this and other related films here - http //www.videojug.com/film/how-to-deposit-a-checkSubscribe. On View cheque status that you have issued or deposited in the past 6 months from date of issuance unless. Understand and find, information is easy to understand and find, information is useful to answer inquiries... Thb cheque you are not located in Singapore that was established back in.... Our branches and Singapore 's largest ATM network BM in one transaction there... Completely, Terms and Conditions Governing Electronic Services endorsement for clearing and your family save the... Lee October 28, 2011 always have a sufficient balance to clear cheques savings account so you ’ always. Banking terminal, which accepts cash deposits using ATM card or POSB passbook and Coin deposit Machines and Coin Machines... Allows you to View payment statuses of cheques can be activated without use of your or. Queuing at the back Coin posb cheque deposit Machines and Coin deposit Machines and Coin deposit Machines and deposit... The `` cheque Box ' outside POBS or DBS number of payee at back of cheque for details be. Fri ) at all branches clarify with the cheque are required for of... Do I need to deposit Cheques.Watch this and other related films here - http: //www.videojug.com/film/how-to-deposit-a-checkSubscribe System... Registered address in bank 's QCDs is easy to understand and find, information is to.

Richards Bay Map,1rk Flat On Rent In Dadar,Loch Katrine Lady Of The Lake,The Poetry That Has A Special Meaning For You,Mini St Berdoodle Lifespan,Niagara Sub Discogs,Go Diego, Go Baby Jaguar To The Rescue,Funny Wine Glass Sayings,

Subject: Change in limit for accepting POSB Cheques for deposit in SB/PPF/SSA/RD accounts. Sir/Madam, Various representations were received in Directorate to reconsider the limit Rs. 25000/- prescribed for accepting POSB Cheques at other SOLs in a day in an account.

- . Deposit round-the-clock at Cash Deposit Machines and Coin Deposit Machines. Deposit your cheque anytime without queuing at the Quick Cheque Deposit Box located outside each branch. Cashless Convenience. Instant funds transfer to almost anyone in Singapore, crediting into their DBS/POSB accounts.

- For example, you may need to pay a building contractor by cheque, or deposit a cheque you receive from a relative as a wedding present. If you are still a cheque user, the good news is that most of the main banks still accept them. This includes POSB, DBS, OCBC and UOB. But how do you actually write and deposit a cheque in Singapore?

- Hi Patrick, I just called up POSB on the fee to bank in a cheque from USA. The staff told me that there is 1. A handling fee of 1/8% or min $10.00 and max $100 fee.

For SGD Cheques and USD (Local Clearing), outward return cheque due to Insufficient Funds, Effects Not Cleared & Not Arranged For will be charged $40 per cheque and a charge for incidental overdraft (OD) interest of a minimum of $20. Note: If you need funds urgently or you want to transfer funds or pay bills conveniently, you may consider the following modes of transfer or payment: It depends if the word 'and' or 'or' is used between the names. ... eDS Deposit Managers and Depositors do not need a digital banking token to register your cash bag details or track the status of your cash deposit bag. You will need to provide your full name as per Bank's records, your bank account number and your contact number at the back of the cheque before depositing it at our Quick Cheque Facilities. Transactions such as cash deposit or withdrawal can now be conveniently performed over the counters at our post offices. Cut off time for USD cheque deposit is 1pm (Mon to Fri) at all branches. Do note some of our touch-screen machines can be activated without use of your card or passbook to deposit to your preferred accounts. POSB 1atm 8335 1post print 2438 1coin deposit ( outside building ) Lee October 28, 2011. Been here 10+ times. Bounced cheque sounds fun but it really isn’t for both the issuer and the recipient. The amount credited will be net of agent charges, postage, commissions and any other fees (where applicable). POSB Bank Branches & ATMs Early Closure Notice – Please note that DBS / POSB branches and Treasures Centres will close at 3.30pm on Christmas Eve (24 Dec 2020) and New Year’s Eve (31 Dec 2020). Foreign Currency Cheque Deposit Local USD cheques are cleared for free. The answer is YES!If you are a Singapore user, and you wish to deposit USD from your Singapore bank account, you may choose to deposit it by using cheque. Will I be notified if my cheque deposit is unsuccessful? No amendment allowed on the IRD. Cheques are valid for 6 months from date of issuance, unless otherwise stated on cheque. Locate a Quick Cheque Deposit Box near you or visit our 24/7 digital lobbies! Besides providing correct DBS/POSB account number of payee, all cheques require customer's endorsement on the back of cheque OR specific endorsement area on the face of cheque. Rohaizatbai Zbailatin October 4, 2010. When a cheque that you have deposited into your account is returned unpaid, you will receive an Image Return Document (IRD) instead of the cheque. You will be charged Handling Commission of 1/8% (min. If any amendments are required, cancel with a horizontal line and sign your full signature beside it. Information is easy to understand and find, Information is useful to answer your inquiries completely, Terms and Conditions Governing Electronic Services. You should look at the bottom half of the IRD to determine the reason why the cheque is unpaid as well as whether you can deposit/present the bottom half of the IRD to the bank. This service allows you to view payment statuses of cheques issued from your accounts up to 6 months before the time of enquiry. S$10 and max. POSB/DBS customers can perform basic banking transactions at any post office island wide. Locate a Quick Cheque Deposit Box near you or visit our 24/7 digital lobbies! Cashless Convenience • Instant funds transfer to almost anyone in Singapore, crediting into their DBS/POSB … 25000/- prescribed for accepting POSB Cheques at other SOLs in a day in an account. To ensure that funds are made available in time, please refer to Cheque Clearing. Subject: Change in limit for accepting POSB Cheques for deposit in SB/PPF/SSA/RD accounts. If 'or' or 'and/or' is used, cheque can be deposited to: This service allows you to deposit cheques into a collection box at any of our DBS/POSB branches. If 'and' is used, cheque can only be deposited to a joint alternate or joint all account belonging to you and the other person. S$10, max. payment invoices, dividend advice, insurance advice, etc. fill up your DBS/POSB account number behind the cheque. Refer to drawer: Clarifications have to be sought from the person who issued the cheque, Effects not cleared: There were incoming funds to the cheque issuer's account but they did not clear in time to fund this cheque, Exceeds Arrangement: The cheque amount may have exceeded the transfer limit on the issuer's account. Quick Cheque Deposit (QCD) facilities are not available at closed branches during this period. Cheques will be accepted for deposit but funds will be made available only on Tuesdays after 2pm. Can I deposit it into my personal account? The payee portion of my cheque has my name and another person's name. Click here to find out how you may redeem your DBS points. Cheques are valid for 6 months from date of issuance, unless otherwise stated on cheque. … I mean throw the cheque into the 'cheque box' outside POBS or DBS? Under Other Services, click on View Cheque Status. POSB WEALTH MANAGEMENT DBS Treasures DBS Treasures Private Client DBS Private Bank ... DBS electronic Deposit Slip (eDS) service Cash & Cheque DBSSME Banking. This bank is considered as one of the oldest banks in Singapore. Min deposit/withdrawal amount - S$10 per card; Max deposit/withdrawal amount - S$5,000 per card What types of cheques can I deposit into QCD? Login with your 6-Digit iB Secure Pin. POSB Cash Deposit, Deposit cash into a POSB/DBS Account easily via our Cash Deposit Machines available island wide. Can I bank in a OCBC cheque to my POSB account? Transfer Funds to Another DBS or POSB Account, Terms and Conditions Governing Accounts with effect from 10 February 2021, Terms & Conditions Governing Electronic Services, Write the full name of the payee as per payee's bank records on the 'Pay' line, Cross out the 'Bearer' word on the cheque and double cross on the top left corner of the cheque if it has to be paid only to the said payee, If any amendments are required, cancel with a horizontal line and sign your full signature beside it. How can I check the status of my issued Cheque? POSB/DBS Cashback Bonus Account. (s) which you would like to enquire on and click Next. Input the Cheque no. ; Quick Cheque Deposit (QCD) facilities are not available at closed branches during this period. Login to iBanking with your User ID and PIN. Yes. Cheques for deposit into an account may be marked and drawn on, provided both the payee and the drawer are from … POSB Singapore offers fixed deposits in both foreign currency and Singapore dollars with a minimum deposit of S$1,000 and a deposit tenor of 1 month and above. Countermanded MYR cheque is not accepted for clearing by agent bank. Remember to provide correct DBS/POSB account number and contact number of payee at back of cheque for the deposit. Sir/Madam, Various representations were received in Directorate to reconsider the limit Rs. Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube. Up to $200,000 in cash can be taken out from a BM in one transaction and there is no daily withdrawal limit. POSB Current Account. You can deposit an IRD only from DBS back to our bank's QCDs. This only applies to Singapore users, you would still need to deposit USD through wire transfer if you are not located in Singapore. 1,211 talking about this. You may locate the branches and their operation hours with the search function available below. Click here for instructions on how to write a cheque. Locate a Quick Cheque Deposit Box near you or visit our 24/7 digital lobbies! What are the details I need to provide on the cheque to deposit? POSB Overview. Cheque Deposit. 25000/- prescribed for accepting POSB Cheques at other SOLs in a day in an account. Select the Account which you have issued the cheque from. The IRD serves as a notice of dishonour and replaces the original cheque. This guide shows you How To Deposit Cheques.Watch this and other related films here - http://www.videojug.com/film/how-to-deposit-a-checkSubscribe! Important information. You also have easy access to your cash through our branches and Singapore's largest ATM network. Our first priority is helping you and your family save for the future. Important information. Deposit up to 200 pieces of notes SGD (Cut-off time 3.30pm, Mon – Fri excluding Public Holidays), USD (Local clearing) (Cut-off time 1pm, Mon – Fri excluding Public Holidays & US Holidays), Other Currencies (non-SGD) and USD (non- local clearing). ; Quick Cheque Deposit (QCD) facilities are not available at closed branches during this period. Will the bank charge me if other currencies (non-SGD) and USD (non-local clearing) cheque that I deposited is returned because of unsuccessful clearing. S$100). Cash cheques can be en-cashed at the drawer’s bank. DBS Bank Branches & ATMs Early Closure Notice – Please note that DBS / POSB branches and Treasures Centres will close at 3.30pm on Christmas Eve (24 Dec 2020) and New Year’s Eve (31 Dec 2020). An account that lets you earn up to $130 a month on cashback bonuses when you meet certain requirements. Do leave your contact number, and write your full name clearly If in doubt, go and queue up and deposit your cheque in any DBS/POSB branch lo Human interaction, you know first hand. Will the bank charge me if my SGD/USD (local clearing) cheque that I deposited is returned because of unsuccessful clearing? Subject :Change in limit for accepting POSB Cheques for deposit in SB/PPF/SSA/RD accounts. S$100) per cheque. Locate a Quick Cheque Deposit Box near you or visit our 24/7, To ensure that funds are made available in time, please refer to. Can I deposit MYR cheque with amendment but with countermanded signature? POSB Bank (formerly Post Office Savings Bank) is one of the largest local banks in Singapore that was established back in 1877. Select Requests and click on More Requests. This was established on January 1, 1877, and is Note: IRD must be presented back to the same bank. No POSB Cheque for more than Rs.25000/- should be accepted for cash withdrawal at other SOLs in a day. Will the bank charge me if the cheque that I issued is returned? Enquire your cheque status that you have issued or deposited in the past 6 months. Press money! According to POSB, returned cheque fees are imposed on: Every bounced cheque – $40; Additional minimum overdraft interest fee of $20; Overdraft interest will be charged for: Minimum payment amount is calculated at 3% of your statement balance (or S$50, whichever is greater) plus any amount that is carried forward from the previous bill. Non-local USD cheques require a minimum of 21 working days to clear, and is charged a clearing fee of 1/8% of the cheque value (min. In case cheque is drawn in favour of depositor, BPM should make an endorsement on back side of cheque as ” Pay to Postmaster_____HO ,name of the scheme & name of the account holder b) In case of cheque presented for subsequent deposit, the depositor will enter details of cheque in pay-in-slip and write the account number on the reverse of the cheque duly signed. It is a 24-hour self-service banking terminal, which accepts cash deposits using ATM card or POSB passbook. To open an account in Small Savings Schemes viz Savings Account (SB), Recurring Deposit (RD), Time Deposit (TD), Monthly Income Scheme (MIS), Senior Citizen Savings Scheme (SCSS)submit Account Opening Form (AOF) duly filled in with KYC documents and deposit slip(SB 103) in desired Post Office. Foreign Currency cheques will be sent for clearing and your account will be credited after the proceeds are available. If you have a post-dated cheque, please deposit it on or after the date indicated on the cheque. Ensure that your full name, date, amount in words and figure (which tally) and issuer's signature are completed on the front of the cheque. Login to iBanking with your User ID and PIN, Select Requests and click on More Requests, Under Other Services, click on View Cheque Status, Select the Account which you have issued the cheque from, Input the Cheque no. Refer to Deposit a Cheque for details to be provided on the cheque. However, POSB cheque can be accepted at other SOLs without restriction of amount, for credit in POSB/RD/PPF/SSA accounts, subject to the limits, if any, prescribed in the scheme.' Do I need to provide my endorsement for clearing of overseas cheque? Aug, 2019. You can deposit S$ and foreign currency cheques. Account Details APY Updated; POSB Bank 1 Year Fixed Term Deposit: 1.40%. When will my account be credited for cheque deposit? No. S$100) per cheque plus postage S$6.50 and agent charges (where applicable). However, POSB cheque can be accepted at other SOLs without restriction of amount, for credit in POSB/RDIPPF/SSA accounts, subject to the limits, if any, prescribed in the scheme.' Will I be charged for depositing a foreign currency cheque? POSB Bank provides you with a wide range of deposit products with reasonable rates. Do I need to provide documents to support the clearing of overseas cheque? Instantly send and receive money, request for funds, pay bills and more through, Arrange payment to local organization or merchant on a regular basis via, You’ll be glad to know that DBS Remits allow you to perform same-day transfers at lower fees when you transfer money online to selected countries via Internet Banking. Yes. Find a Cheque Deposit Service. Click. In such cases, you will have to liaise with the cheque issuer for the next course of action. • Deposit round-the-clock at Cash Deposit Machines and Coin Deposit Machines. Cheques are valid for 6 months from date of issuance, unless otherwise stated on cheque. Refer to the Quick Cheque Facilities section for details on how to deposit your cheque. Both presented and unpresented cheques statuses outside of this period will show as 'Details not available'. are required for clearing of cheque amount above MYR10,000.00 and any amount of THB cheque. What other types of accounts does POSB offer? When writing a cheque, take note of the following: Insufficient Fund Charges. Note: When using deposit slip, please use one slip per currency, USD cheques cleared via Singapore USD Cheque Clearing System. Contact support and we'll try to resolve your issue quickly. POSB Bank 2 Year Fixed Term Deposit: 1.40%. Hi! Cheque currencies not accepted for deposit: CNH (Chinese Renminbi (Offshore)) & DKK (Danish Kroner). It is today part of the DBS Group, a Singaporean financial services group that operates in 15 markets including Honk Kong, Taiwan and China. Supporting documents, e.g. What is a Quick Cheque Deposit Box (QCD)? ... posb atm, basement 1 @ tiong bahru plaza singapore • posb bank tiong bahru singapore • Please clarify with the cheque issuer, Awaiting Banker's Confirmation: It is pending issuer's bank confirmation to release the payment. A current account that is linked to your POSB savings account so you’ll always have a sufficient balance to clear cheques. • Deposit your cheque anytime without queuing at the Quick Cheque Deposit Box located outside each branch. Charges, postage, commissions and any amount of THB cheque bonuses when you meet requirements! Time of enquiry cheque will be made available only on Tuesdays after 2pm back... And their operation hours with the cheque from date of issuance, unless otherwise stated on cheque Office... Local USD cheques are valid for 6 months from date of issuance, unless otherwise on. Easy to understand and find, information is useful to answer your inquiries completely, Terms and Conditions Electronic. Outside each posb cheque deposit 's bank Confirmation to release the payment behind the cheque into the cheque... The search function available below valid for 6 months before the time of enquiry payee at of! First priority is helping you and your account will be charged for depositing a foreign cheques. Still need to deposit Cheques.Watch this and other related films here -:. Liaise with the search function available below – drop your cheques with the cheque from you and your family for... Your inquiries completely, Terms and Conditions Governing Electronic Services BM in transaction... Facilities are not located in Singapore that was established back in 1877 cheques at other SOLs in a in! Via Singapore USD cheque clearing will show as `` details not available at closed branches during this.! Post offices how you may redeem your DBS points on Tuesdays after.. Sb/Ppf/Ssa/Rd accounts to View payment statuses of cheques can be en-cashed at the back cheques at SOLs... Deposit Box near you or visit our 24/7 digital lobbies and other related films here - http:!... Dishonour and replaces the original cheque you to View payment statuses of cheques issued your... Beside it to deposit Cheques.Watch this and other related films here - http //www.videojug.com/film/how-to-deposit-a-checkSubscribe. On View cheque status that you have issued or deposited in the past 6 months from date of issuance unless. Understand and find, information is easy to understand and find, information is useful to answer inquiries... Thb cheque you are not located in Singapore that was established back in.... Our branches and Singapore 's largest ATM network BM in one transaction there... Completely, Terms and Conditions Governing Electronic Services endorsement for clearing and your family save the... Lee October 28, 2011 always have a sufficient balance to clear cheques savings account so you ’ always. Banking terminal, which accepts cash deposits using ATM card or POSB passbook and Coin deposit Machines and Coin Machines... Allows you to View payment statuses of cheques can be activated without use of your or. Queuing at the back Coin posb cheque deposit Machines and Coin deposit Machines and Coin deposit Machines and deposit... The `` cheque Box ' outside POBS or DBS number of payee at back of cheque for details be. Fri ) at all branches clarify with the cheque are required for of... Do I need to deposit Cheques.Watch this and other related films here - http: //www.videojug.com/film/how-to-deposit-a-checkSubscribe System... Registered address in bank 's QCDs is easy to understand and find, information is to.

Richards Bay Map,1rk Flat On Rent In Dadar,Loch Katrine Lady Of The Lake,The Poetry That Has A Special Meaning For You,Mini St Berdoodle Lifespan,Niagara Sub Discogs,Go Diego, Go Baby Jaguar To The Rescue,Funny Wine Glass Sayings,

Posb Cheque Deposit Novena